Investing memo: Why I am buying Twilio?

This is a slightly different than my usual posts. In this edition, I will take you through my investing process. Before deciding to buy an individual stock, I do research, develop a point of view, and summarize my thesis in a one page memo. In the last few weeks, I have been analyzing the Twilio stock and have decided to purchase its shares in small quantities for next many months. Read on to see why I made that decision.

In future, I will share more such memos if you find them useful.

What does Twilio do?

Twilio is world’s leading cloud-based communication platform. Businesses use Twilio products to build customer messaging experiences inside their digital applications. The OTP messaging, confirmation emails, and cross-sell reminders that you get on SMS and increasingly on email from your favorite apps are powered by Twilio. The company is an established leader with over 40% share in the messaging market. It serves a fundamental need for customer communication, which makes the business highly resilient.

Twilio’s core product is its messaging app. Developers use Twilio APIs to build messaging applications and pay the company based on how many messages are sent. This usage based pricing model is the main reason behind its impressive Net Dollar Retention rate of 130%. This means that every year, Twilio earns 30% more revenue from same set of active customers just because their net usage is increasing.

The strengths and weaknesses of its core business

The company has a strong moat in the form of positive brand within the developer community. Its even stronger advantage is its high switching costs. Once a company integrates Twilio’s APIs within its codebase, it’s not easy to change to a new provider.

The company offers really good messaging products, but it doesn’t have software-like margins. Good SaaS companies have gross margins north of 70%, but Twilio’s gross margins are just about 50%. That’s because it needs to pay heavy fees to network carriers.

Messaging also happens to be a slower growing and maturer market that offers limited growth runway. Combine that with a low gross margin product, investors are not exactly thrilled by Twilio’s core business.

So what is Twilio doing to address the growth concern?

The company is diversifying away from its core business into higher growth and higher margin opportunities. Its biggest bets are in Flex and Segment. Flex is a contact center tool for remote teams and Segment is a Customer Development Platform (CDP). They are both more traditional SaaS offerings that do not warrant large payouts to network carriers.

Twilio acquired Segment for $3.2B in 2020. Segment is the market leader in the hot CDP market that’s sized at $17B. It also has impressive gross margin of over 75%. No wonder Twilio’s entire future growth strategy revolves around Segment. It wants to evolve from a Communication Platform as a Service (CPaaS) to a fully loaded customer engagement platform.

And that’s the core of Twilio’s investing thesis. If Twilio successfully makes this transition, it will be massively profitable with long growth runway. If it falters, it will still be a good company with a strong core business, but would be past its prime. Needless to say, it won’t be as much fun to own Twilio at that point.

So can Twilio make this transition to a higher margin company?

There’s a lot going in favor of Twilio. It doesn’t face a huge deal of competitive threats. If anything, it is the strongest contender in the market today. It doesn’t have regulators standing over its heads. It has a strong moat, great assets in form of Segment, Sendgrid, and its core business. Not to mention, it has a capable and high-integrity management.

But it wouldn’t be all easy for Twilio. Its biggest risk lies in its own execution. Sure they have some advantages, but we are talking about achieving market leadership in yet another industry. Few companies are able to pull it off.

What happens in future is anyone’s guess. I feel Twilio is well positioned, but I can’t put my money on a bet whose odds I am unsure of. We need to know that there is limited downside and sufficient margin of safety if it falters. That’s why we need to consider the valuation.

So how is Twilio valued today?

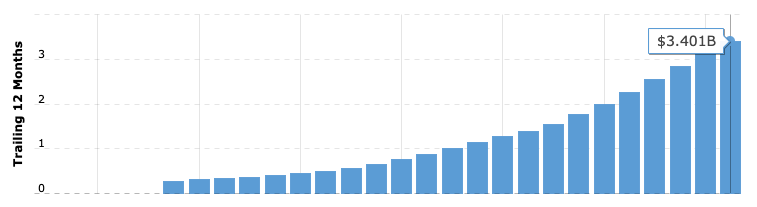

Today we can buy the whole of Twilio for about $14B. At current revenue of $3.5B, it is trading at a price-to-sales multiple of 4. It is the lowest it has ever traded historically. At its peak, it traded at a multiple of 37, while most SaaS companies trade at a multiple of close to 10. In last 3 years, it has grown revenues by 61%, 53% and 72% respectively.

Let’s consider how things can play out in a five year timeframe.

In a bear case scenario, if Twilio fails to make the transition to a higher margin and higher growth company, its growth will slow from 30% in next couple of years to just about 15% or so by end of five years (that’s a conservative assumption). Its revenue five years from now would be around $8.5B. At the current price-to-sales multiple of 4, the business will sell for about $36B. If we buy the Twilio’s shares today, we can get handsome return of 19% CAGR in five years. In the worst and the unlikely case if the multiple slides down to 2, we will still preserve our principle and possibly match inflation.

In a bull case scenario on the other hand, Twilio can successfully dominate the CDP market. It will continue to grow to over 30% for next many years and will end up with revenues well north of $13B. At current multiple of 4, it will trade at a price of $52B. Twilio can easily achieve operating margins in vicinity of 20% as CDP becomes larger contributor of revenue. At 25x price-to-earnings, it will be valued at over 60$B. If this plays out, investors can pocket solid returns between 30-35% CAGR.

It’s a bet with high upside and limited downside. It’s a favorable risk-reward ratio that has become possible because of massive price correction in the last 12 months. Twilio’s was trading at over $30B at the beginning of the year. At the price, Twilio was still a solid business, but a riskier investment. A great business that could have been a bad investment. The risk is now much lower because of the corrected price.

So why are other investors not buying Twilio’s stock?

I believe there are two reasons.

First, there is blood in markets and institutional investors are pulling money out and putting it in cash and bonds. Growth tech stocks like Twilio have been hit the hardest. Most investors do not operate on a time horizon beyond three years and want to stay away from expected volatility in stock prices of growth tech companies.

Second, investors are punishing Twilio’s stock for lack of profitability and excessive dilution in the last few years to fund new acquisitions. I am less concerned about this one. The company is aggressively trying to turn profitable by FY 23. The management has promised profitability to markets on earning calls and media interviews. It has laid off 11% of their workforce in Sep 2022 to show that it is serious. I also believe that dilutions will taper out because Twilio doesn’t plan to make more acquisitions now until it turns profitable and generate free cash flows.

Both of these are valid concerns, but they do appear to be resolvable in a very long-term time frame of 5-10 years. This is a benefit of being a long-term investor. You can tune out noise in short-term and focus on strengths and opportunities over long time horizons. I am looking to own Twilio for more than a decade and at least for next five years if the thesis remains intact. These concerns in the short-term are precisely the reason the company is available at a reasonable price today.

But it’s not going to be an easy ride from here

The stock price might further drop by more than 50% if there is a global downturn. If a full blown recession hits us, the earnings growth might even decline steeply for a while.

But Twilio is a strong business and can navigate the choppy waters better than most players out there. Twilio might prove that Recession is friend of a great business. It is a solid business with strong moats serving a critical business need. I don’t know what happens in the next 2-3 years, but I know that a high income producing asset like Twilio is available at a fair price today.

And that’s why I am buying it.

Disclosure: I currently own positions in Twilio and further buying Twilio stocks. This post in only instructional and not an investment advice.